What banks are paying 4 on CDs?

Signature Federal Credit Union

Signature offers products like money market accounts, credit cards, IRA certificates, and more. Signature Federal Credit Union offers stellar APYs on all its certificates, especially its shorter-term certificates (6 months to 24 months) which provide APYs of up to 5.00%.

| Institution | Rate (APY) | Term |

|---|---|---|

| EFCU Financial | 4.50% | 48 months |

| NexBank | 4.45% | 48 months |

| Popular Direct | 4.45% | 48 months |

| Lafayette Federal Credit Union | 4.42% | 48 months |

| Term | APY | Provider |

|---|---|---|

| 6 Month | 5.75% APY | Andrews Federal Credit Union |

| 1 Year | 5.50% APY | TotalDirectBank 1 Year CD |

| 18 Month | 5.20% APY | Credit Human Credit Union |

| 2 Year | 5.27% APY | Pelican State Credit Union |

Signature Federal Credit Union

Signature offers products like money market accounts, credit cards, IRA certificates, and more. Signature Federal Credit Union offers stellar APYs on all its certificates, especially its shorter-term certificates (6 months to 24 months) which provide APYs of up to 5.00%.

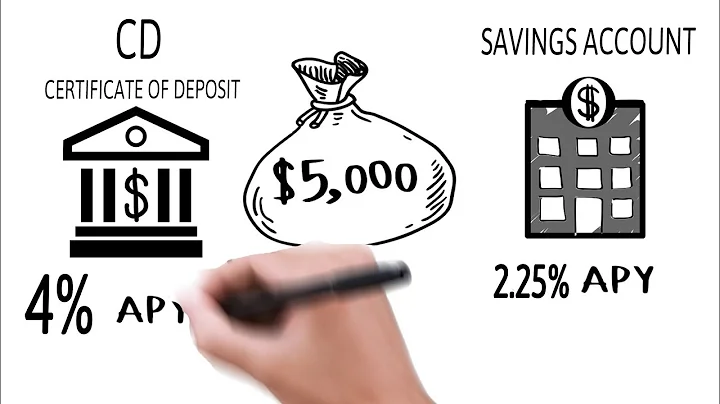

To determine what a "good" rate is, simply compare what CDs are currently offering to what you can get with a regular savings account. Savings account interest rates currently hover around 0.43%, while interest rates on CDs are around 4.5% to 5% or higher, depending on the lender and other factors.

Which bank gives 7% interest on a savings account? There are not any banks offering 7% interest on a savings account right now. However, two financial institutions are paying at least 7% APY on checking accounts: Landmark Credit Union Premium Checking Account, and OnPath Rewards High-Yield Checking.

No financial institutions currently offer 7% interest savings accounts. But some smaller banks and regional credit unions are currently paying more than 6.00% APY on savings accounts and up to 9.00% APY on checking accounts, though these accounts have restrictions and requirements.

So, should you open a CD now or wait? It could very well be the time to buy, especially since the Fed has indicated it will likely stop raising rates and start cutting them in 2024. Although many investors had anticipated a rate cut in March, Fed Chair Jerome Powell recently suggested that a cut was unlikely that soon.

| Institution | Rate (APY) | Term |

|---|---|---|

| Hughes Federal Credit Union | 5.65% | 17 months |

| Hughes Federal Credit Union | 5.60% | 17 months |

| One American Bank | 5.51% | 5 months or 11 months |

| My eBanc | 5.51% | 6 months |

Chase's standard CD rate is 0.01% APY, but with a linked Chase checking account, you qualify for relationship rates ranging from 0.02% APY to 5.00% APY depending on the term and account balance.

Are there 6% CDs?

There isn't a nationwide bank offering a 6% CD right now, but there are a few credit unions with CDs that pay 6% APY or more (although you'll need to meet their membership eligibility requirements). See if you qualify for a 6% interest CD.

- Credit One Bank – 5.25% APY for a one-year CD, $100,000 minimum deposit for APY.

- Suncoast Credit Union – 5.25% APY for a one-year CD, $100,000 minimum deposit for APY.

- Navy Federal Credit Union – 5.10% APY for a one-year CD, $100,000 minimum deposit for APY.

People who are already retired – or retiring in the near future – should consider a CD and lock in a rate now. That way they can potentially keep up with or even be ahead of long-term inflation. There's no guarantee that inflation will stay at elevated levels, however. It could increase or decrease in the future.

You'll earn $850.50 for a total of $15,850.50 after one year when you open a $15,000 1-year CD with Popular Direct when calculating the returns at current rates. A 1-year CD at LendingClub Bank or CIBC Bank USA will produce $847.50 or $843.00 in returns, respectively. Lock in strong returns with a one-year CD today.

Open your CD as part of a retirement account

So, your income taxes will be deferred until you tap into your IRA in retirement. If you opt for a Roth IRA, your money grows tax-free. You do pay income taxes on the money you open the IRA with, but you won't pay income taxes on its growth.

| Type of 1-year CD | Typical APY | Interest on $100,000 after 1 year |

|---|---|---|

| CDs that pay competitive rates | 5.30% | $5,300 |

| CDs that pay the national average | 1.59% | $1,590 |

| CDs from big brick-and-mortar banks | 0.03% | $30 |

DCB Bank savings account interest rates

DCB Bank offers up to 8% interest on savings accounts with balances ranging from Rs 10 lakh to less than Rs 2 crore. The bank pays 7.75% interest on savings account balances ranging from Rs 10 crore to less than Rs 200 crore. The rates are effective from September 27, 2023.

- Stocks.

- Real Estate.

- Private Credit.

- Junk Bonds.

- Index Funds.

- Buying a Business.

- High-End Art or Other Collectables.

- Best earning a high APY: Western Alliance Bank Savings Account.

- Best for no minimum deposit: Newtek Bank Personal High Yield Savings.

- Best for no fees: Bask Interest Savings Account.

- Best for easy access to your cash: Panacea High-Yield Savings Account.

Can You Get a 7% CD Account? There was a lot of excitement in August 2023 about a few credit unions offering 7% APYs on certificates. But those rates were offered for a limited time only, and are no longer available as of January 2024.

Which bank gives 6% interest on savings account?

Currently, there's only one account that pays 6% APY — Digital Federal Credit Union's savings account — and it only pays 6.17% APY on balances up to $1,000.

CDs can help accelerate your savings, but they're not always worth it. If there's a chance you'll need access to your money during your CD's term, consider a high-yield savings account or money market account. But if you have a pool of money you can afford to lock up, it may be worth capitalizing on high CD rates.

While it's unlikely, a certificate of deposit (CD) could lose money if you withdraw funds before you've earned enough interest to cover the penalty charged. Typically, CDs are safe time deposits that guarantee an interest rate for the term that you agree to keep money at a financial institution.

Banks and credit unions often charge an early withdrawal penalty for taking funds from a CD ahead of its maturity date. This penalty can be a flat fee or a percentage of the interest earned. In some cases, it could even be all the interest earned, negating your efforts to use a CD for savings.

For context, in 2021, when rates were around their lowest, the national average 12-month CD had an APY of just 0.15%. For a $5,000 deposit, this is the difference between earning $250 in interest over a year versus earning only $7.50 over that same time frame.

References

- https://www.cnet.com/personal-finance/banking/cds/are-certificates-of-deposit-safe/

- https://m.economictimes.com/wealth/invest/up-to-9-fd-interest-rate-which-bank-offers-highest-fixed-deposit-rate-for-2-3-year-tenure/articleshow/105554828.cms

- https://groww.in/blog/best-savings-bank-accounts-you-can-opening

- https://www.business-standard.com/finance/personal-finance/fd-for-senior-citizens-here-are-the-best-rates-but-should-you-invest-124030400428_1.html

- https://www.cnbc.com/select/why-now-is-perfect-time-to-open-cd/

- https://m.economictimes.com/wealth/save/6-banks-offering-up-to-8-interest-rate-on-savings-accounts/articleshow/105990711.cms

- https://www.livemint.com/money/personal-finance/this-bank-is-giving-up-to-9-5-return-on-bank-fixed-deposits-fds-to-senior-citizens-11707034213109.html

- https://www.investopedia.com/do-cds-pay-compound-interest-5248340

- https://www.bankrate.com/loans/personal-loans/average-personal-loan-rates/

- https://www.investopedia.com/best-4-year-cd-rates-5272503

- https://www.forbes.com/advisor/banking/pros-and-cons-of-using-a-certificate-of-deposit-cd-for-your-savings/

- https://www.forbes.com/advisor/banking/cds/best-6-month-cd-rates/

- https://www.valuepenguin.com/personal-loans/average-personal-loan-interest-rates

- https://www.moneysavingexpert.com/savings/best-regular-savings-accounts/

- https://finance.yahoo.com/news/10-return-investment-roi-141300511.html

- https://time.com/personal-finance/article/best-way-to-earn-interest/

- https://lendedu.com/blog/how-much-money-do-you-need-to-live-off-interest/

- https://www.forbes.com/advisor/banking/cds/are-cds-worth-it/

- https://www.investopedia.com/ask/answers/060616/can-certificates-deposit-cds-lose-value.asp

- https://www.forbes.com/advisor/banking/savings/7-percent-interest-savings-account/

- https://www.bankrate.com/banking/cds/paying-tax-on-cd-interest/

- https://www.thetimes.co.uk/money-mentor/banking-saving/savings-accounts/best-savings-accounts

- https://www.bankbazaar.com/fixed-deposit/fd-rates-above-9percentage.html

- https://www.fool.com/the-ascent/banks/articles/this-is-how-much-money-you-can-make-with-20k-in-a-high-yield-savings-account/

- https://fortune.com/recommends/banking/should-you-open-certificate-of-deposit-now-or-wait/

- https://www.investopedia.com/what-can-i-earn-with-10k-in-a-cd-8400034

- https://www.bankrate.com/banking/cds/best-jumbo-cd-rates/

- https://moneyfactscompare.co.uk/savings-accounts/regular-savings-accounts/

- https://www.cbsnews.com/news/why-you-should-put-15000-into-a-1-year-cd-now/

- https://www.forbes.com/advisor/banking/cds/7-percent-cd-rate/

- https://www.idfcfirstbank.com/personal-banking/accounts/savings-account/interest-rate

- https://growbeansprout.com/best-savings-accounts-singapore

- https://www.nasdaq.com/articles/if-you-put-%245000-into-a-cd-how-much-will-you-make

- https://www.latimes.com/compare-deals/banking/savings/7-percent-interest-savings-accounts

- https://www.investopedia.com/checking-account-high-yield-options-8363635

- https://www.nerdwallet.com/article/banking/when-to-break-a-cd

- https://m.economictimes.com/wealth/invest/fd-interest-rates-6-banks-offer-9-or-more-on-senior-citizen-fds/articleshow/106047974.cms

- https://www.gobankingrates.com/banking/interest-rates/how-much-interest-does-10000-earn-in-a-year/

- https://finance.yahoo.com/news/long-short-term-cds-better-174726215.html

- https://www.bankrate.com/banking/cds/is-now-the-time-for-longer-term-cds/

- https://www.fool.com/the-ascent/personal-loans/what-is-good-interest-rate-personal-loan/

- https://www.kiplinger.com/personal-finance/banking/cd-rates-are-rising-shop-around-to-get-the-best-returns

- https://www.cnbc.com/select/best-high-yield-savings-accounts/

- https://www.sofi.com/learn/content/can-a-certificate-of-deposit-cd-lose-value/

- https://www.marketwatch.com/guides/cds/chase-cd-rates/

- https://www.cnbc.com/select/5-percent-interest-savings-accounts/

- https://www.bankrate.com/banking/cds/the-pros-and-cons-of-cd-investing/

- https://www.finder.com/savings-accounts/12-interest-savings-account

- https://www.cbsnews.com/news/can-you-avoid-taxes-on-cd-account-interest/

- https://www.forbes.com/advisor/banking/cds/are-cds-taxable/

- https://www.businessinsider.com/personal-finance/6-percent-interest-savings-accounts

- https://www.businessinsider.com/personal-finance/7-percent-interest-savings-accounts

- https://fortune.com/recommends/banking/the-best-cd-rates/

- https://www.livemint.com/money/personal-finance/top-5-banks-offer-highest-interest-rate-on-fixed-deposits-to-senior-citizens-sbi-hdfc-bank-icici-kotak-mahindra-bob-11706869917918.html

- https://www.cbsnews.com/news/whats-good-cd-interest-rate/

- https://www.fortunebuilders.com/how-to-invest-10k/

- https://fortune.com/recommends/investing/safe-investments/

- https://www.experian.com/blogs/ask-experian/how-many-cds-can-you-have/

- https://www.businessinsider.com/personal-finance/7-percent-interest-cd-certificate-of-deposit

- https://www.nerdwallet.com/article/loans/personal-loans/safe-small-dollar-loans

- https://www.cbsnews.com/news/where-can-i-get-highest-interest-on-my-money-what-experts-say/

- https://www.bankrate.com/banking/cds/how-much-100000-could-earn-you-1-year-cd/

- https://time.com/personal-finance/article/how-many-bank-accounts-should-you-have/

- https://www.investopedia.com/best-high-yield-savings-accounts-4770633

- https://www.raisin.co.uk/savings/monthly-interest-accounts/

- https://www.dosslaw.com/definitive-guides/doss-law-llps-definitive-guide-to-usury-in-california/

- https://www.cbsnews.com/news/why-you-should-deposit-10000-into-a-5-year-cd-now/

- https://www.cnn.com/cnn-underscored/money/are-cds-taxable

- https://www.businessinsider.com/personal-finance/who-has-the-best-cd-rates-right-now

- https://www.bankrate.com/banking/checking/best-free-checking-accounts/

- https://www.sofi.com/learn/content/average-savings-by-age/

- https://www.investopedia.com/best-jumbo-cd-rates-4797766

- https://www.bankrate.com/banking/cds/cd-rate-forecast/

- https://www.businessinsider.com/personal-finance/6-percent-certificate-of-deposit-cd

- https://poe.com/poeknowledge/1512928000358234

- https://www.gobankingrates.com/banking/banks/what-happens-to-cds-if-the-market-crashes/

- https://www.cbsnews.com/news/should-i-open-cd-now-or-wait/

- https://www.cnet.com/personal-finance/banking/advice/ways-to-save-money-and-earn-interest/